Headlines

Grist: Deep-sea mining could begin next year. Here’s why ocean experts are calling for a moratorium.

Eco-business: Ukraine war gives ammunition to the deep-sea mining lobby

New York Times: Oil prices rise and trading is halted in nickel after price surge.

Financial Times: London Metal Exchange suspends nickel trading after contract soars to $100,000 a tonne

Reuters: Nickel price booms on short squeeze, Russia supply concerns

The Maritime Executive: Report: Germany Seizes First Russian-Owned Megayacht

Papers

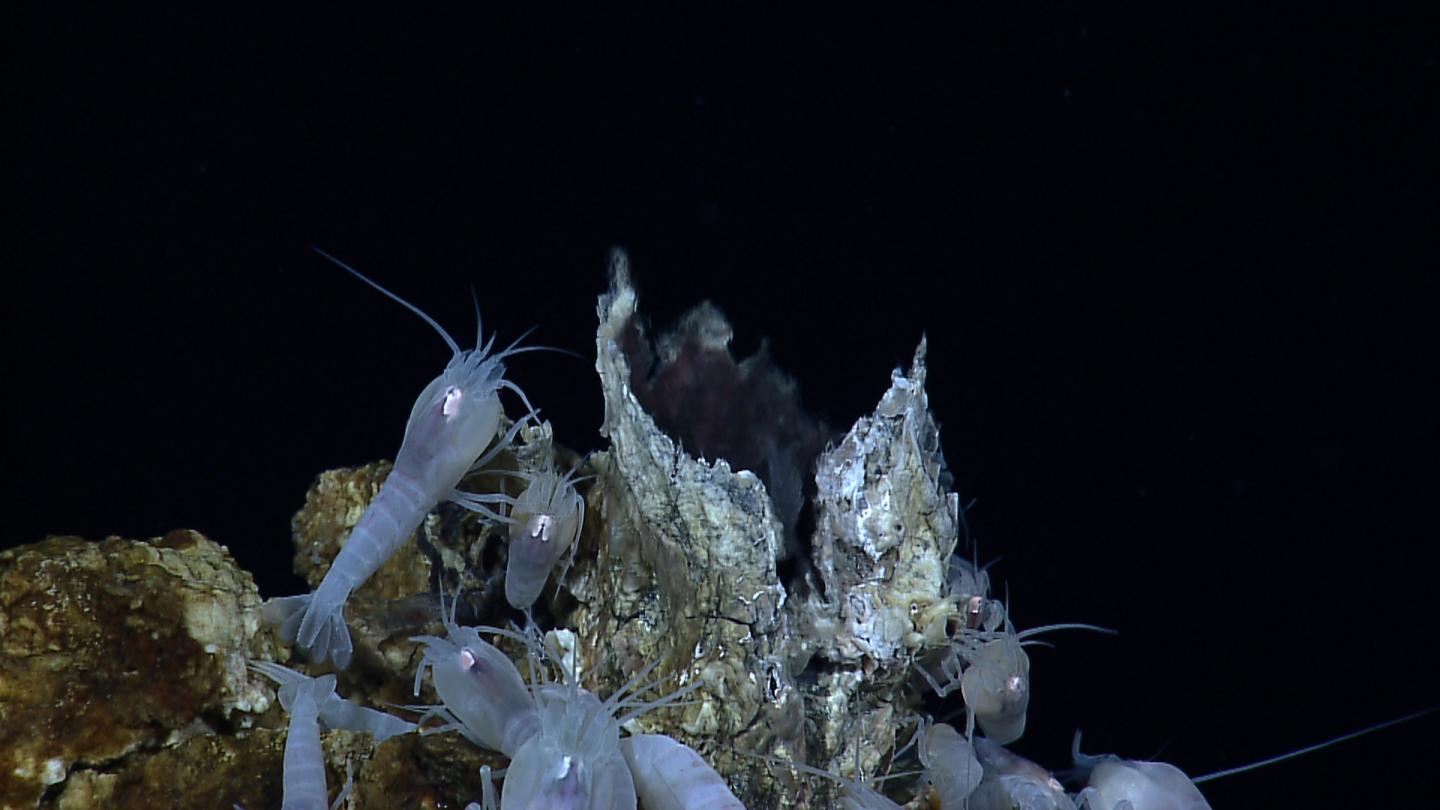

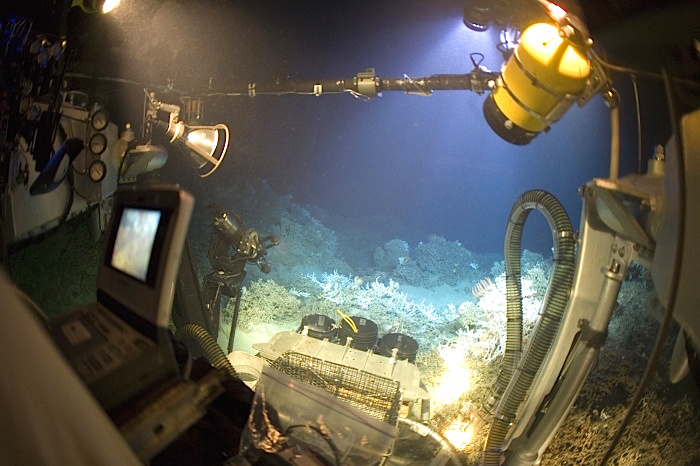

Journal of Marine Science and Engineering: Influence of Different Particle Parameters and Operating Conditions on Flow Characteristics and Performance of Deep-Sea Mining Pump

Marine Policy: Assessing plume impacts caused by polymetallic nodule mining vehicles

Marine Policy: Assessment of scientific gaps related to the effective environmental management of deep-seabed mining

Views

Following market panic over the intensifying sanctions against Russia, the price of Nickel briefly rocketed to over $100,000 per tonne. By the time the London Metals Exchange halted trading, the price had fallen to about $80,000 per tonne. This briefly places the value of Nickel above Cobalt, though it will almost certainly fall back to a more reasonable price as markets stabilize. At the moment, though, a US nickel (25% nickel content), which has a face value of $0.05 now contains about $0.10 worth of Nickel. At the time of publishing, The Metals Company stock prices has climbed by over 50% on the day.

In other tangential news, Germany seized the $600 million mega-yacht of Alisher Usmanov, one of the Russian oligarchs sanctioned by the European Union last week. Usmanov was a major investor in the former Nautilus Minerals and is a co-owner of Deep Sea Mining Finance, which acquired many of Nautilus’s assets following liquidation.