Last week DeepGreen announced that it had finalized the acquisition of Tonga Offshore Mining Limited, a subsidiary of the former Nautilus Minerals, from Deep Sea Mining Finance, who is overseeing Nautilus’s restructuring. Outside of Solwara I, TOML was one of Nautilus’s most valuable holdings, and though the acquisition price has not been revealed, it will likely have a significant effect on the bankrupt company’s continued restructuring.

This places DeepGreen in a strong position to take the lead in the race to reach commercial production. “The TOML project will enable us to bring more critical mineral resources to market to break through the bottleneck and shift away from fossil fuels,” says DeepGreen CEO Gerard Barron. The acquisition also brings with it a trove of environmental data and scientific samples, which could allow DeepGreen to jumpstart the Environmental Impact Assessment process and accelerate thare timeline for production, and advantage that will be immeasurably valuable during a moment when most of the world’s economy is in pandemic-induced hibernation.

Representatives from DeepGreen indicate that at least one Tongan employee from TOML will transition over to DeepGreen, while they will continue working in close collaboration with the remaining contractors.

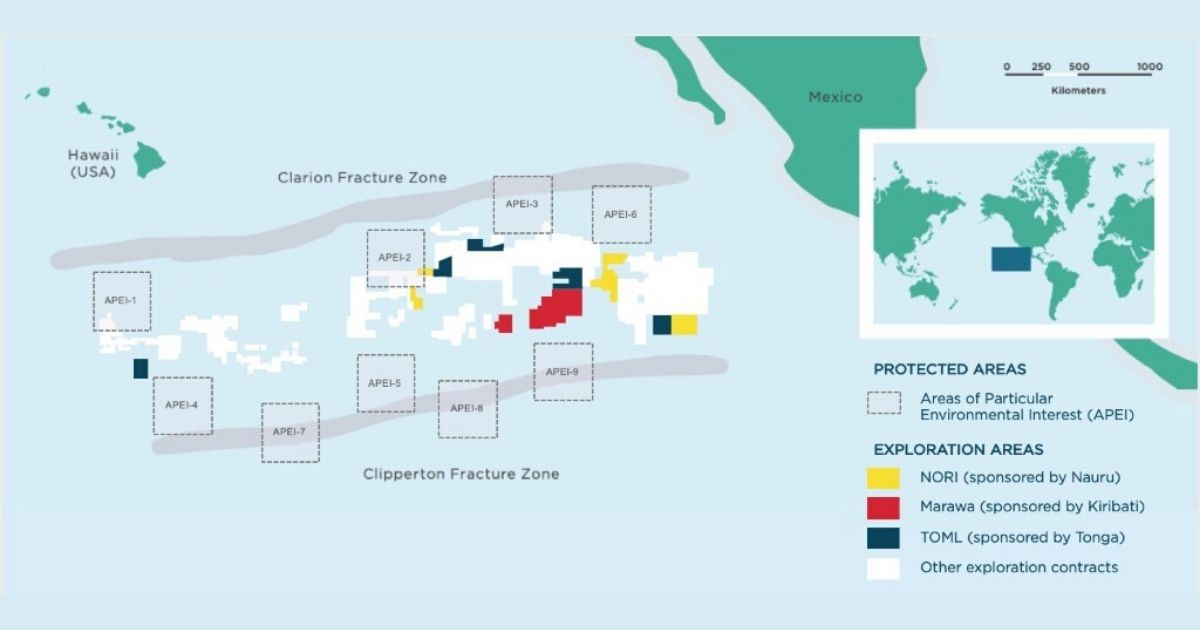

TOML will be DeepGreen’s third contract area in the Clarion-Clipperton Fracture Zone. They also hold contracts on a lease through Nauru Ocean Resources Inc. sponsored by the Republic of Nauru and a second lease through a partnership with Marawa Research and Exploration Ltd. sponsored by the Republic of Kiribati. TOML was also Nautilus MInerals only polymetallic nodule prospect, suggesting that the future of the pioneering company now resides exclusively with seafloor massive sulphides.

Featured Image: Map of CCZ featuring TOML and other DeepGreen lease blocks. Image courtesy DeepGreen.