RANJEETHA PAKIAM on BLOOMBERG MARKETS | 14 November 2017

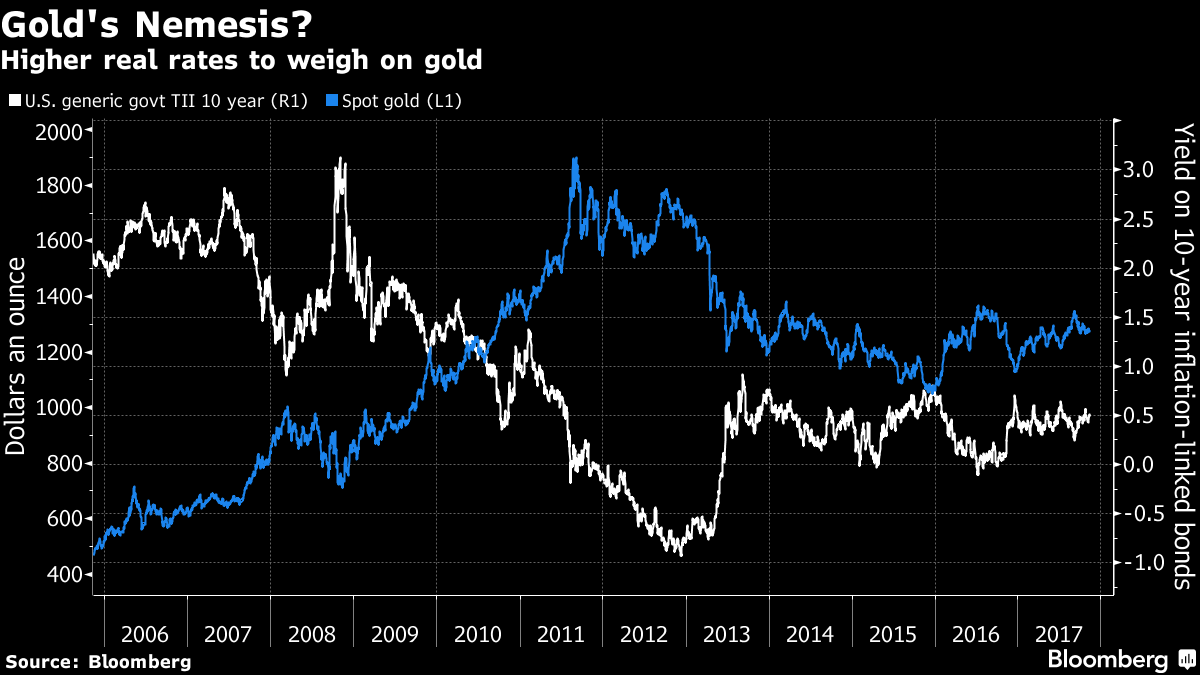

“Gold may be set on a perilous path as central banks withdraw the liquidity punch bowl that has driven stock markets to record highs.

As a world recovery gathers pace, the Federal Reserve is shrinking its balance sheet and raising interest rates, while the European Central Bank is about to begin tapering bond purchases. This scenario makes it very hard for a non-interest bearing asset like gold to do well, according to Troy Gayeski from SkyBridge Capital, which managed more than $11 billion at the end of August.”