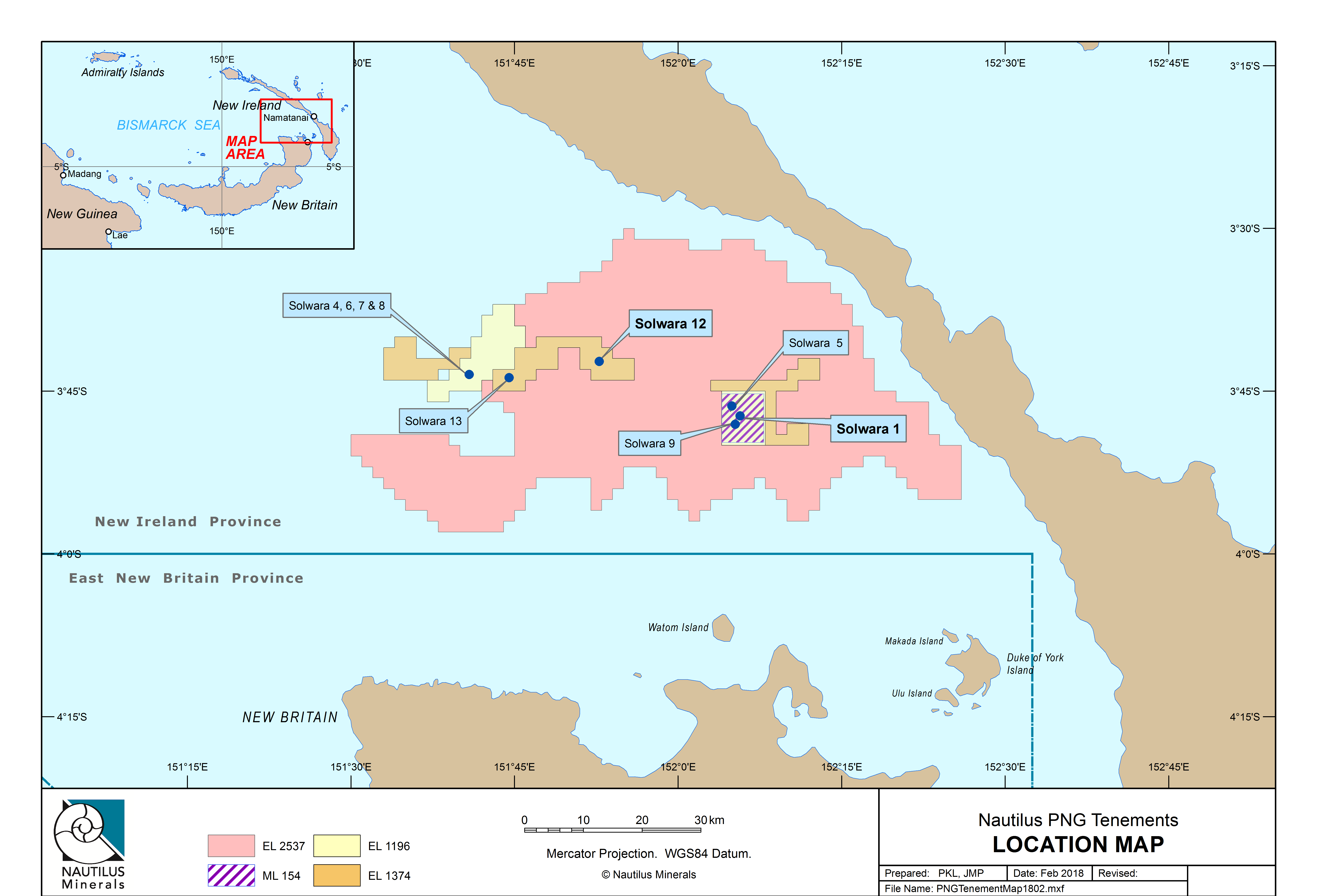

The last half year was a tough one for Nautilus Minerals. In December, their ship contractor defaulted on payments to the production support vessel and construction was halted following contract resolution. This was followed in July by notification that the shipbuilding contract had been cancelled. In May, they lost the support of Anglo American, who pulled their investments from the Solwara I project. And just last week, long-time CEO Mike Johnston resigned, to be replaced by venture capitalist John McCoach.

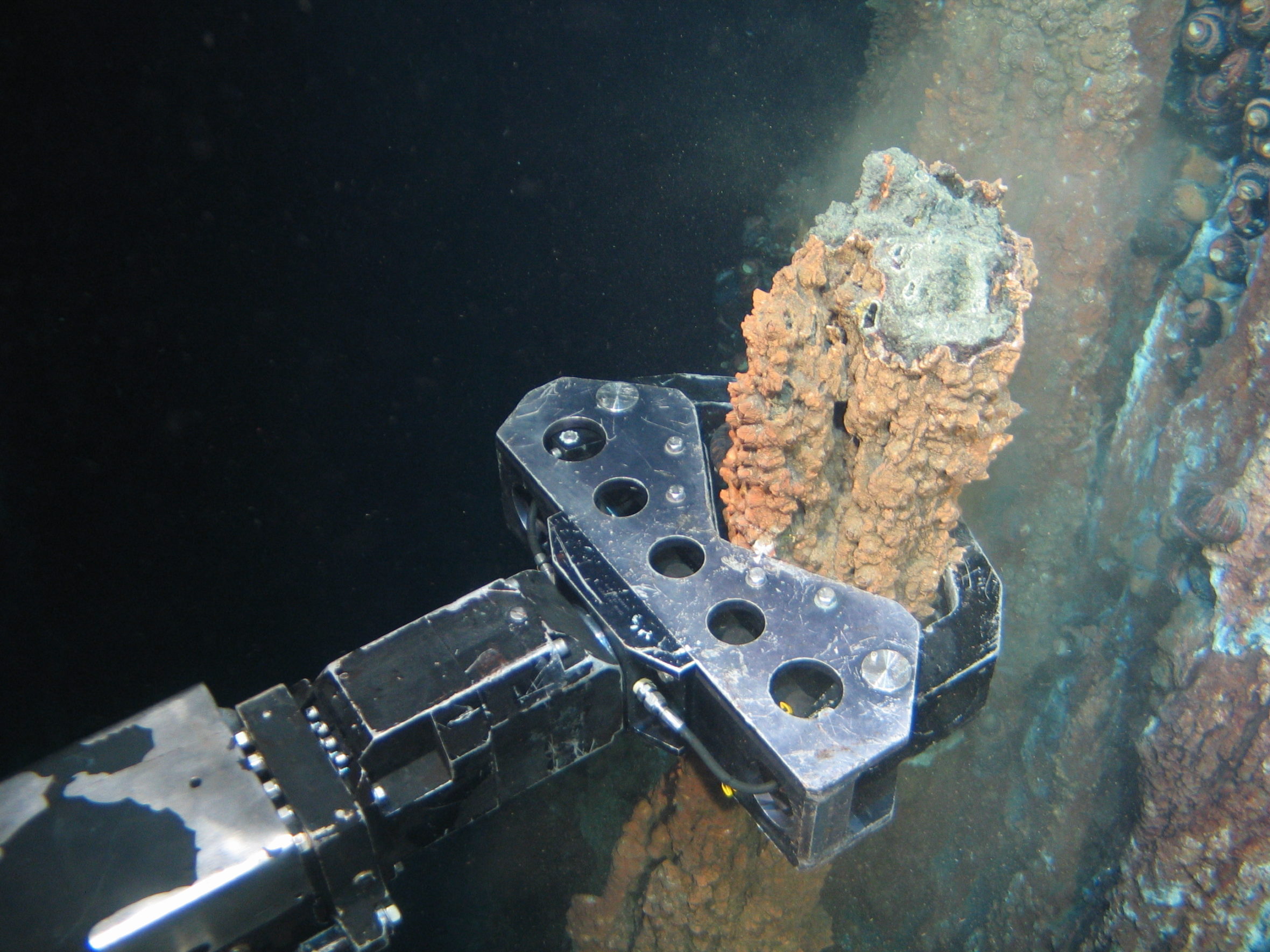

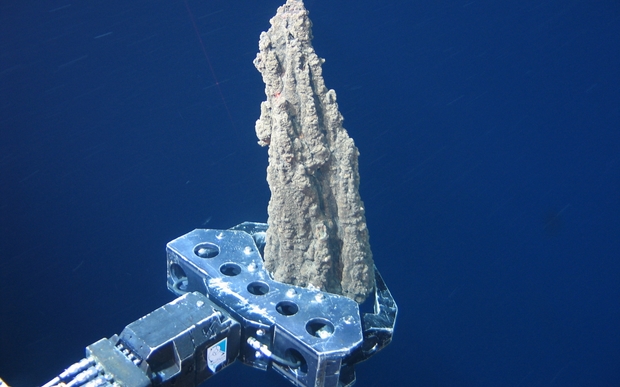

The production support vessel is a complex machine capable of supporting both crew and the three seafloor production tools operating in tandem on the ocean floor. Without a highly-specialized support vessel, it would be impossible for Nautilus to get the seafloor production tools on site. The construction contract is held by Marine Assets Corporation (MAC), a firm that specializes in offshore support vessel operations. Nautilus Minerals then holds a contract with MAC for delivery of the vessel and a 5-year charter. It’s MAC who ultimately defaulted on the contract payments. Nautilus, however, does have the option to cover production costs itself, which it has so far declined to do.

With the production support vessel over 75% complete, the hull already floating, and the launch-and-recovery system for the seafloor production tools installed, it’s not entirely clear what the long-term impacts of this current crisis will be on the development of Solwara 1. Fujian Mawei Shipbuilding will need to recoup its loses, either by finding a new buyer to take over the contract or by completing the ship itself to then lease or sell to an interested party.

The Solwara I production support vessel, christened Nautilus New Era, is built to accomplish one very specific task: supporting three unique seafloor production tools in continuous, simultaneous operation in places like the Bismarck Sea. Ultimately, regardless of how the vessel is financed and finished, the only real client currently prepared to charter it is Nautilus Minerals.

Representatives for the Fujian Mawei Shipbuilding could not be reached for comment.

The ship news came in tandem with the divestment of Anglo American, a minority shareholder in Nautilus Minerals, from the Solwara I project. Though not directly stated by Anglo American representatives, who describe the decision as a “prioritization of our portfolio on our largest and greatest potential resource assets”, the Deep Sea Mining Campaign credited pressure from environmental groups and statements by Sir David Attenborough, who described deep-sea mining as “deeply tragic”, for the divestment.

There are few details surrounding the departure of Mike Johnston, who has led Nautilus Minerals since 2012 and has been with the company since 2006. This is the second leadership change for 2018, as the chairman of the board, Russell Debney, resigned in January over frustration with finding financial backers. Though they’ve secured several bridge loans from major shareholders, Nautilus Minerals may still need as much as $350 million to get Solwara I to production.

Representatives from Nautilus Minerals were not available for comment.

It’s not easy predict exactly what this news means for the future of Nautilus Minerals. Despite the seemingly bleak outlook, the mining company still claims to be on track to become the first company to bring ore from seafloor massive sulphides to market. Nautilus has endured significant set-backs in the past, from tense negotiations with the government of Papua New Guinea, to funding shortfalls which resulted in significant reductions in workforce, to even a hacking scandal which saw $10 million vanish overnight.

Despite all these setbacks, Nautilus Minerals continues to edge towards production at Solwara I. Just this week, they announced an additional loan from Deep Sea Mining Finance Ltd. If the ecosystems surrounding Solwara I are half as resilient as the mining company, Nautilus’s claims of environmentally sustainable resource extraction might just pan out.