The Financial Model, the mechanism by which the ideals built into the founding principles of the ISA—that mineral resources in the high seas are the common heritage of humankind—are manifested in practice, is perhaps the most challenging component of launching any deep-sea mining venture. The financial model is predictive, based on myriad assumptions about what production on the deep seafloor will look like, how valuable the resources actually are, and what the future demands for precious metals will be. It allows the member states to assess and agree upon appropriate royalties to be disbursed in accordance with the common heritage principle. It allows contractors and their investors to predict what their profit margins will actually be, and it allows to ISA to determine what fees to levy to fund the Enterprise, maintain the Authority, anticipate liability needs, and implement monitoring programs.

During the last month’s meeting, the General Council struggled towards solidifying what the financial model will ultimately look like.

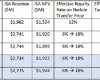

Ahead of the General Council meeting, an informal working group gathered to discuss the four proposed models that could be adopted by the ISA. These include a proposal by the African Group, China Southern University, the German Federal Ministry for Economic Affairs, and the Massachusetts Institute of Technology. Surprisingly, the models aren’t really all that different. They waiver between a 2% and 20% royalty based on the estimated value of the resource, with time frames ranging from 16 to 30 years. Where they differ is in the details, and in assumptions about the future of the industry, and those difference can have huge implications for the bottom line.

That royalty rate is naturally the biggest concern for contractors. Under the African model, a royalty rate as high as 20% should still yield high returns for the contractor, though the model also presents a scenario where a 2% royalty for the first eight years of production followed by 4% for the remaining production would yield a 27% rate of return. Importantly, the African model predicts a raw value for cobalt that is nearly 30% higher than the next higher prediction, a value that seems to have emerged from projections based on last summer’s spike in cobalt value. The price of cobalt has declined significantly since then.

In contrast, the Chinese model argues that the royalty rate should not exceed 2%.

Where the MIT model deviates substantively from the other three is in where in the process of converting minerals from the deep sea into metals for production royalties are calculated. The African, Chinese, and German models all treat mining as a vertically integrated industry, with profits emerging from the sale of metals post-refining (a process that happens on land). The MIT model points out that the ISA may have no jurisdiction over land-based revenue generation and that it is not unlikely that miners and refiners will be different entities, thus the model calculates profits at the point of collection. For royalties based on the estimated value of a bucket of nodules, this distinction is irrelevant, but for those based on gross profit, this has a significant impact on the return rate for contractors and on how much the ISA can collect from contractors.

Where the models also deviate in ways that impact the bottom line are in assumptions about ramp-up rate (how long it takes to get to full production), the actual value of the resource, the cost of refining ore into usable metals, whether manganese is included in the estimates, and the cost of high seas operations.

Regardless of the financial model that the Council ultimately settles on, the one clear outcome from these discussions is that the unknowns inherent in a new kind of extractive industry, the first that has to balance commercial interests with the common heritage principle, have far more impact on the bottom line than the finely tuned particulars of the royalty rate.

Read the MIT Report here: Financial Regimes for Polymetallic Nodule Mining: A Comparison of Four Economic Models.