Of the coast of Namibia, in barely 200 meters of water, an entirely different kind of deep-sea mining is taking shape. The target is neither precious metals, rare earth elements, or the minerals destined to supply next-generation batteries and power cells, but diamonds. The company is De Beers, the world’s largest diamond producer, and they currently operate the largest underwater mining robots in the world.

Offshore diamond mining in Namibia, which began in 2002, has a nearly two-decade head start on the nascent deep-sea mining industry. Though it differs from mining for resources like polymetallic nodules, seafloor massive sulphides, and cobalt-rich crusts in substantive ways, the industry faces many of the same challenges and serves as a useful proxy for a mature marine mining industry.

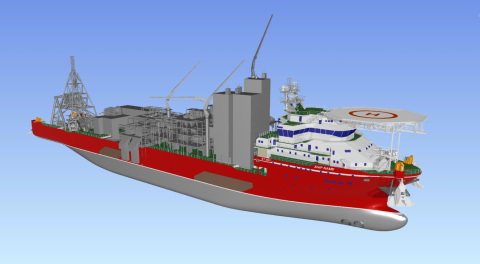

De Beers operates 6 ships engaged in offshore diamond mining which run either an airlift-drill system that reduces the top few meters of the seafloor to a pump-able slurry before delivering it to the support vehicle or, among the newer ships in their fleet, a benthic crawler. These crawlers, super-sized versions of Nautilus Minerals seafloor production tool, travel across the seabed, reducing diamond-bearing deposits into manageable chunks before pumping them to the surface. As in most proposed deep-sea mining operations, tailings are returned to the seafloor.

The process closely resembles a hybrid between DEME Group and DeepGreen’s proposed harvesting crawlers for polymetallic nodules and Nautilus Mineral’s topography reducing seafloor production tools.

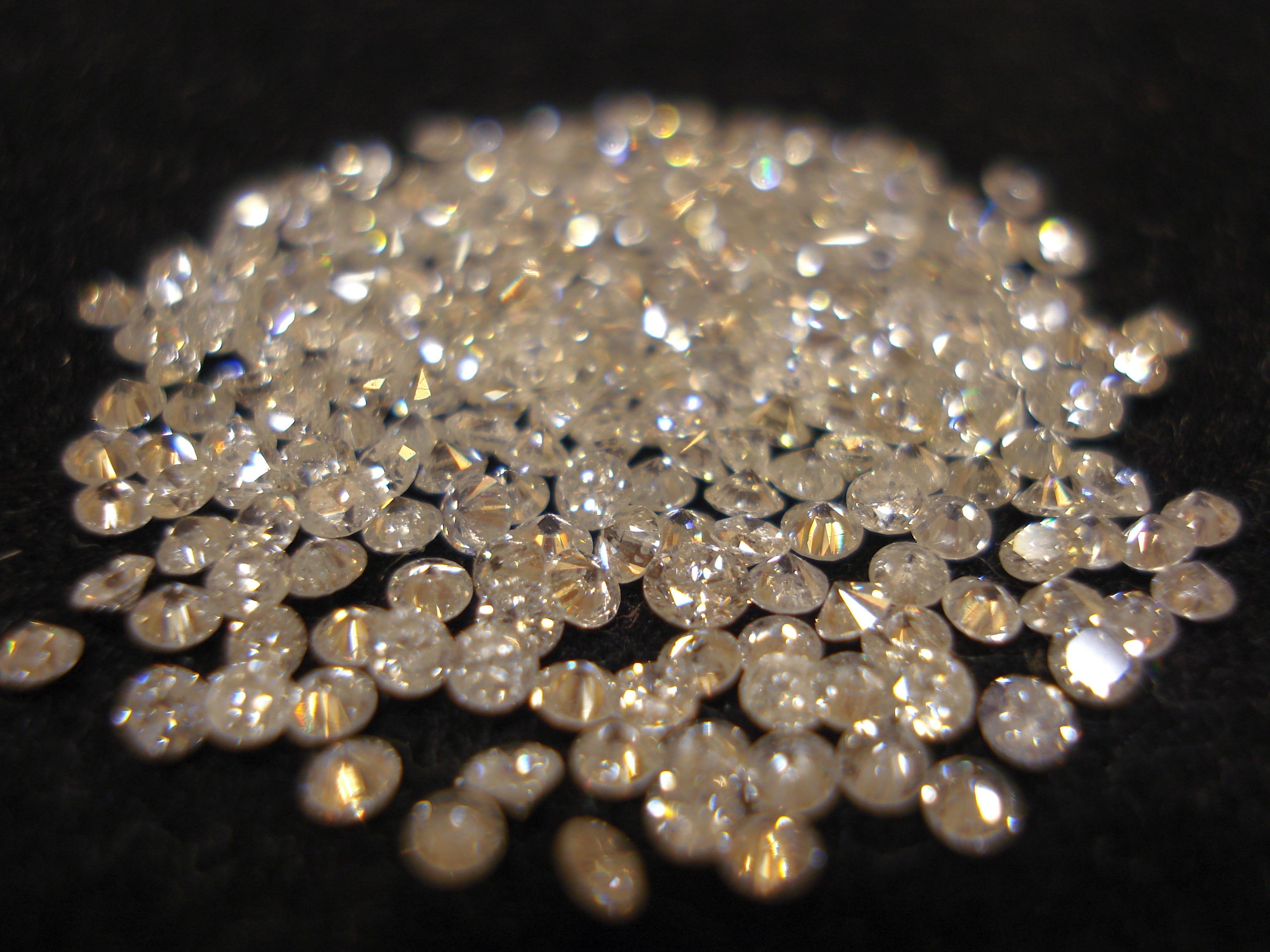

The process takes a dramatic departure from other marine mining ventures once the resource reaches the deck. Unlike gold, cobalt, copper, and other minerals locked up in the seabed resources of the deep ocean that require substantial processing to access, diamonds are a luxury commodity that can be isolated aboard ship. Even small diamonds can have tremendous value. De Beers ship-board processing is designed to minimize the potential for human contact with the resource until it can be cataloged and secured. Diamonds recovered from the seafloor are sorted mechanically and sealed into bar-coded containers before being transported via helicopter to vaults onshore.

De Beers is so concerned about securing their supply chain against any loss that they are developing a blockchain-based registry to track every diamond from production to final sale.

De Beers faces many of the same environmental concerns that deep-sea miners are grappling with in the lead-up to production. The disturbance to the immediate seafloor is total, the impact of returned tailings is poorly understood, plumes from production spread may beyond the limits of their lease block, and long-term monitoring, even at a relatively shallow depth, is technologically and logistically complicated. In both cases, the footprint is relatively small compared to the overall ecosystem. Of their 2,316 square mile lease block, De Beers has identified 617 square miles that contain diamond-bearing ores and has mined only mine 50 square miles of that.

And, much like the deep-sea mining industry, offshore diamond mining comes with the same arguments for sustainability and social good. In both cases, land-based exploitation of their respective resources has come with significant human costs. Both diamonds and cobalt have been major drivers of colonialist expansion and sustained conflicts on the African continent. A pressing need for resources also drives the push offshore (though, for De Beers, “need” is less a function of supplying a rapidly expanding push for reliable alternative technologies to supplant fossil fuels and more a function of market forces). De Beers estimates their terrestrial holdings will run out in approximately 15 years and are actively exploring alternative deposits. Marine operations now account for almost 75% of total diamond production in Namibia. Unlike deep-sea mining, there is strong movement now towards lab-grown diamonds, which even De Beers, who once pledged never to develop artificial diamonds, now backs.

The same principle investors are also involved in both industries. Anglo America, one of Nautilus Minerals major shareholders until they divested from the project last year, also owns an 85% stake in De Beers.

Beyond operating in the ocean, perhaps the strongest similarity between the two industries is the need for effective marketing to sell their respective resources to the public. De Beers is widely credited with implementing the most effecting marketing campaign in history, A Diamond is Forever, convincing a huge swath of the western world that their product had tremendous social value. Currently, several deep-sea mining companies are working hard to convince the public that their resources are the green alternative to conventional mining and an essential step in the climb towards a circular economy and a fossil-fuel-free future.