After nearly two decades of promise and two years of confusion and uncertainty, it looks like the curtain has finally closed on Solwara I and Nautilus Minerals. In the mid-2000’s, Nautilus Minerals made their mark as the first commercial venture to explore seafloor massive sulphides for potential mineral extraction. In the early 2010’s the company had secured not only an exploration permit from the government of Papua New Guinea, but an exploitation lease, the first license to be issued to a commercial entity to mine the deep ocean within a nation’s territorial waters. They had the permit, the environmental impact assessment, the mining tools, and a ship under construction.

And then things fell apart.

Over the last year, Nautilus has been restructuring following their bankruptcy. As Deep-sea Mining Finance they have, in the last few months, sold off their polymetallic nodule holdings in Tonga to DeepGreen. This leaves Solwara I as their sole remaining mining lease. Recent signals from the Papua New Guinea government suggest that PNG may no longer be interested in allowing any continued development of the prospect.

Late in 2019, the PNG government indicated support for a moratorium on deep-sea mining. This week, the Prime Minister’s office announced plans to unveil a new national ocean policy to manage the country’s ocean resources, and it does not look promising for any entity interested in exploiting the Solwara I prospect.

“The Solwara 1 project continues to remind us, as a nation, to be careful in how we deal with our maritime resources, the blue economy that we have.” said Deputy Prime Minister Davis Steven. “Our Government’s priority right now is to reform the law, take back PNG using lawful means, building investor confidence, building industry, building capacity but what belongs to the people of Papua New Guinea must be given to the people and not by stealing but by the right way.” he added.

The Deputy Prime Minister also indicated that they were looking into legal avenues to recoup their losses from the Solwara 1 Project — the Government of PNG invested significantly into the development of Solwara I and is eager to recoup their losses– as well as the formation of a committee to determine how the project was approved, what went wrong, and what lessons can be learned.

Papua New Guinea has not, however, ruled out future exploitation at Solwara I entirely. “For me,” says Deputy Prime Minister Steven, “Solwara 1 project has potential, however, we have to be careful in the absence of a policy, in the absence of a framework, to protect our resources.”

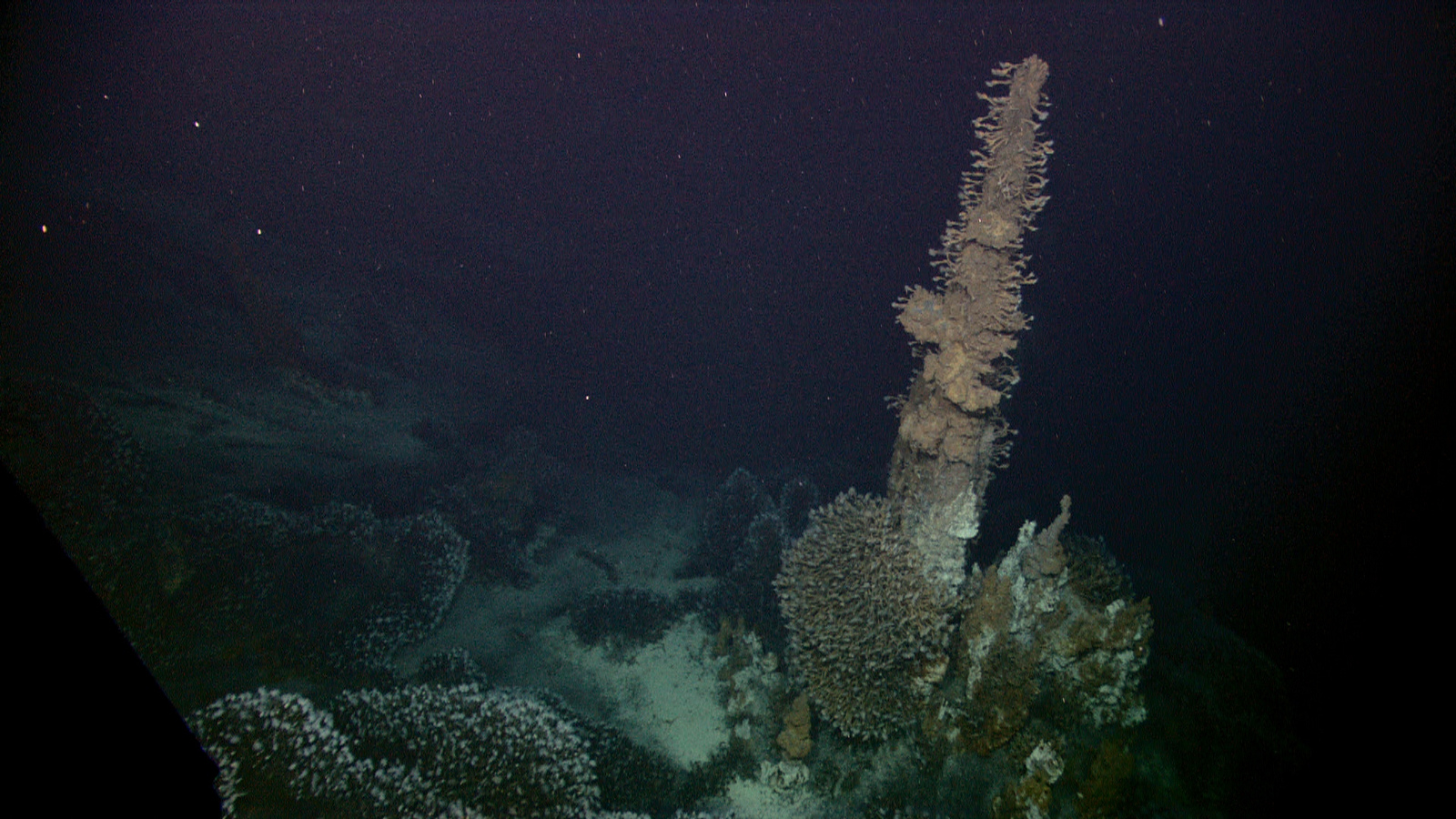

With no clear pathway to production on Solwara I and no other lease holdings, Deep-sea Mining Finance would seem to be lacking in assets. However, the company still owns the 3 seafloor production tools — currently the only large scale extraction system that has undergone testing — as well as at least 12 patents for various technical components of deep-sea mining systems, including several for drilling, seafloor mining, and riser and lift systems. While it is unlikely that the company that was once poised to be the world’s first deep-sea mining venture has a future in direct extraction, a Nautilus-derived entity will likely continue to exist to license technologies to other deep-sea mining ventures.

Beyond that, Nautilus Minerals was a formative mover in the modern revival of deep-sea mining, and its leadership and expertise has spread throughout the industry. Nautilus veterans are represented among the staff of contractors, research institutions, governments, and NGOs. Even the DSM Observer’s own editor got his earliest experience in the industry aboard a Nautilus Minerals research cruise.

Though the company no longer exists, the legacy of Nautilus Minerals will persist throughout the deep-sea mining industry.

Featured image: A satellite flyover shows the Nautilus Seafloor Production Tools undergoing testing in Port Moresby.