Andrew Thaler for the Deep-sea Mining Observer

This month, The Metals Company completed its reverse merger with Sustainable Opportunities Acquisition Corp and was formally listed as $TMC on Nasdaq. On September 17, Chairman and CEO of The Metals Company Gerard Barron, rang the opening bell at the Nasdaq MarketSite in Times Square.

In a press release announcing the successful merger and listing, Barron said: “Public listing and access to public capital markets is an important milestone in our mission to solve the raw materials challenges of the clean energy transition. I want to give a heartfelt welcome to our new investors who participated in this transaction and thank our existing partners and investors who continue to support our important mission and our evolution from DeepGreen to The Metals Company.”

Unfortunately, at least two of those investors felt otherwise. Following the reverse merger, two investors failed to deliver on promised funding, which may account for almost two-thirds of the supplementary funding expected from investor in the reverse merger. The Metals Company is now in the unenviable position of having to seek legal remedies against their potential shareholders to force delivery of the promised funds.

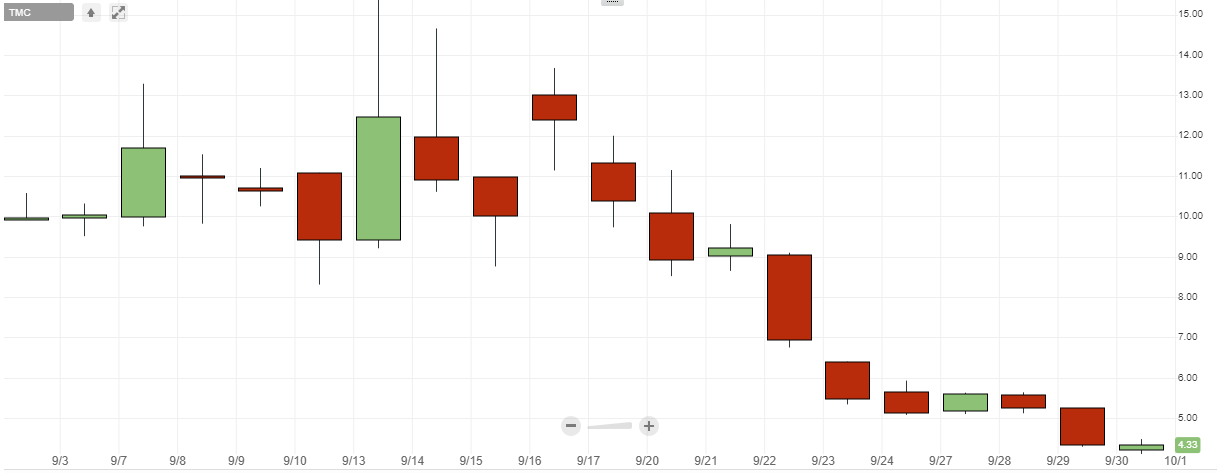

That news alone may have triggered a sell-of among worried investors, but the timing could not have been worse for The Metals Company. Public listing came on the heels of the IUCN vote in support of a moratorium on deep-sea mining following a summer of extensive campaigning from environmental groups against the developing industry. The invocation of Article 15 attracted extensive international scrutiny to mining contractors. And beyond the deep-sea mining community, the US and international stock markets tumbled amidst the news that the Chinese developer Evergrande could default on its debts.

But while their financial situation continues to be fluid, The Metals Company announced several major technical milestones which put them on track to begin commercial production in the near future. They successfully segregated critical battery metals from polymetallic nodules using a process that will, according to The Metals Company, result in the production of alloys with zero waste.

“From a metallurgical perspective, nodules are a great feedstock to work with,” said Dr. Jeffrey Donald, TMC Head of Onshore Development, in a press release. “They have high grades of valuable metals, few impurities, low variability, and come in shapes and sizes that make them very easy to handle, significantly reducing the cost and complexity of the processing.”

The company also announced that its ship, the Hidden Gem, has arrived in Rotterdam to begin conversion from drillship to the world’s first deep-sea mining vessel.

“If you read the latest reports from the Intergovernmental Panel on Climate Change and the International Energy Agency, it’s clear that the transition to clean energy simply cannot happen at scale and on the schedule needed to keep global warming at bay without urgent, large-scale investment in the upstream production of critical metals.” said Barron in the same press release announcing public listing. “We believe we have a solution that is more scalable, secure, lower cost and lower impact than mining these minerals on land: We can produce battery metals from high-grade polymetallic nodules found on the seafloor in the international waters of the Clarion-Clipperton Zone.”

As of the time of writing, TMC was trading at $4.33, a loss of $11.06 from its all-time high of $15.39.

Featured Image: Nasdaq chart for $TMC during the month of September