Download the Nautilus Minerals Press Release

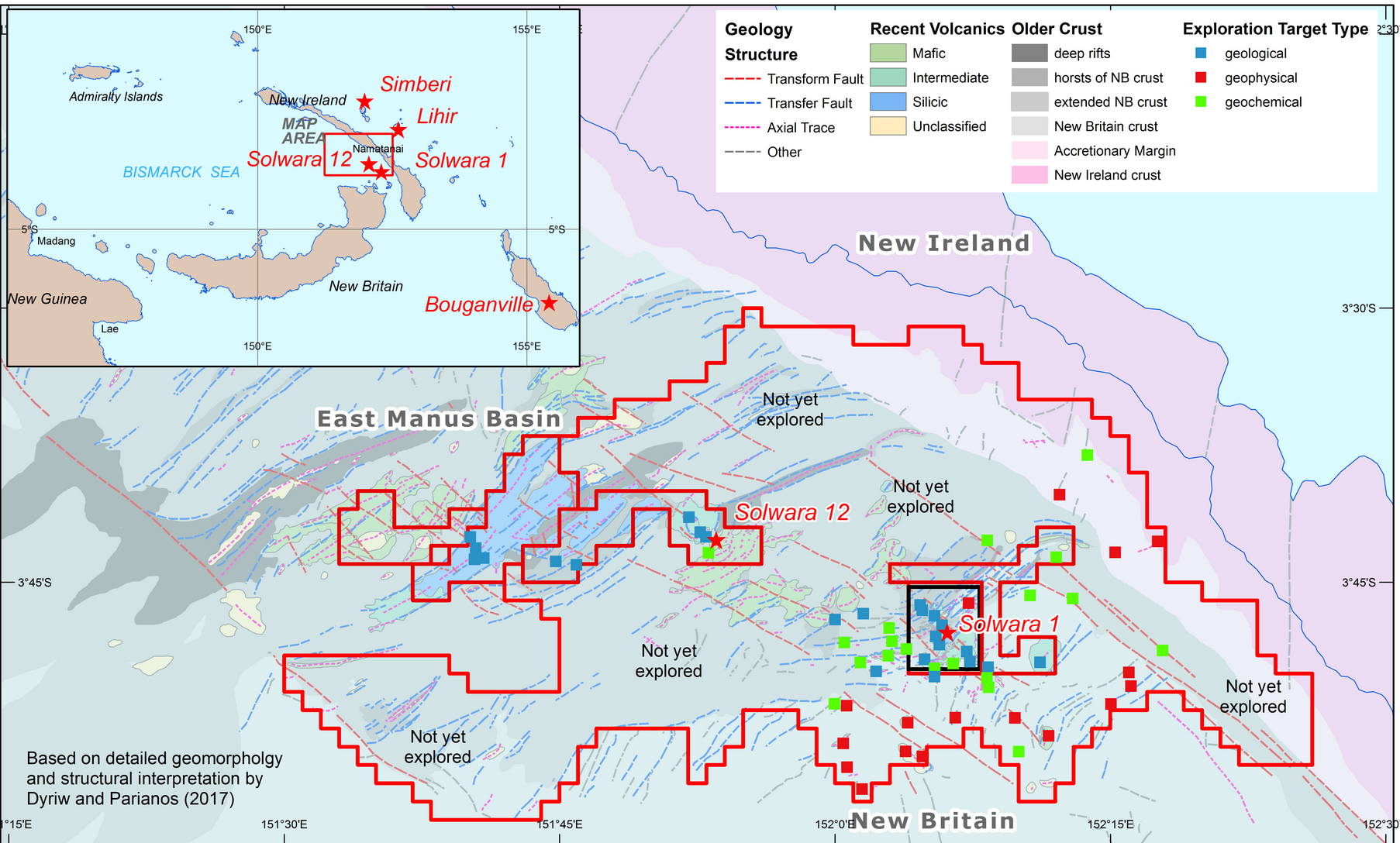

Toronto Ontario, February 27, 2018 – Nautilus Minerals Inc. (TSX:NUS, OTC:NUSMF Nasdaq Intl Designation) (the “Company” or “Nautilus”) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) prepared by AMC Consultants Pty Ltd (“AMC”), contained in an independent National Instrument 43-101 (“NI 43-101”) technical report, for the development of the Solwara 1 Project in the Bismarck Sea of Papua New Guinea (“PNG”).

The PEA, entitled “Preliminary Economic Assessment of the Solwara Project, Bismarck Sea, PNG,” details the proposed production system and methodology, and provides estimates of operating costs, CAPEX to completion, metal production, and cash flows.

Highlights include:

- Solwara 1 is fully permitted

- PNG Government is a 15% partner

- 15 month ramp up to “steady state” production (~3,200 t/d)

- Steady-state payable metal production per quarter ~ 2 0 kt Cu and 29 koz Au

- C1 costs*

- US$1.36/lb Cu for the entire deposit

- US$0.80/lb Cu when at projected “steady state” (3,200 t/d)

- Undiscounted post-tax net cash flow of US$179 million

- Discounted net cash flow, discounting at 15% per annum, of US$56 million

- IRR base case 28%*, rising to 40% using average forward curve metal prices for copper and gold during the production period (as at the PEA’s effective date)

- ~US$243 million of CAPEX remaining to be raised (subject to financing) and spent until

production commences - Taxes and royalty payments from Solwara 1 are estimated to be more than USD$100 million over the 3 year project life (including ramp-up)

The PEA models first production starting Q3 2019, and also shows that the Project has a high fixed cost component (~52%), largely vessel related, and is highly leveraged to metal grade, metal prices, equipment utilization and production rates. The maximum capacity of the production system is designed at ~6,000 tpd. AMC believes that if a steady-state production rate of 4,500 tpd is achieved, not an unreasonable target in their assessment, then C1 costs would be expected to be lowered to around USD$0.63/lb Cu (net of by

-products), well in the lower half of the first quartile of the world copper production curve.

Mike Johnston, Nautilus’ CEO commented: “We are very excited by the results of the PEA.

Expected C1 operating costs at US$1.36/lb Cu for the entire project are in the lower half of the cost curve, and include the 15 month ramp up period. Expected “steady-state” C1 operating costs of US$0.80/lb Cu sit comfortably in the lower half of the first quartile of the production curve, and highlight the potentially seriously disruptive nature of seafloor mining to the world’s mining industry. These are very competitive capital and operating costs, and have additional room to move.”

The production systems on which the PEA is based are currently under construction.

The Nautilus business model is based on using the capital, IP, and know how that Nautilus has developed for the Solwara 1 Project, and applying it to future discoveries at minimal additional CAPEX cost, and with a much reduced “ramp up curve” for subsequent projects.

The oceans have significant potential to provide the key minerals (copper, gold, silver, zinc, nickel, cobalt and manganese) needed by the world as it transitions to a low carbon future based on electric vehicles and batteries. Nautilus’ seafloor production system with its very small environmental footprint, lack of tailings, and industry leading OPEX and CAPEX costs,

will allow the Company and its partner, Eda Kopa (Solwara) Limited to lead the world in this exciting new industry.

About AMC and the Technical Report

The Company’s subsidiary, Nautilus Minerals Niugini Ltd, engaged AMC to undertake the PEA for the Solwara 1 Project and compile a technical report compliant with NI 43-

101. AMC is one of the world’s most trusted mining consulting companies and operates from eight offices in Australia, Canada, Singapore, Russia and the United Kingdom. It helps mining leaders find smarter ways to mine and unearth hidden business value. AMC provides specialist services in geology and mineral resource estimation, mining engineering, mineral processing, geometallurgy, and geotechnical engineering. Its

global team of experts prepares mine feasibility studies, conducts studies to optimize and improve operating mines, and provides specialist technical reports for corporate and financial transactions. AMC has a long track record of producing high-quality results that provide confidence to explorers, miners and investors.

The Company is today filing the technical report dated February 27, 2018, prepared by AMC entitled “Nautilus Solwara 1 PEA”. The authors of the technical report, all of whom are “qualified persons” under NI 43- 101, are Ian Thomas Lipton, Edward Vincent Gleeson,

and Peter Munro. The technical report will be available under the Company’s profile on the SEDAR website at www.sedar.com as well as on the Company’s website at www.nautilusminerals.com.

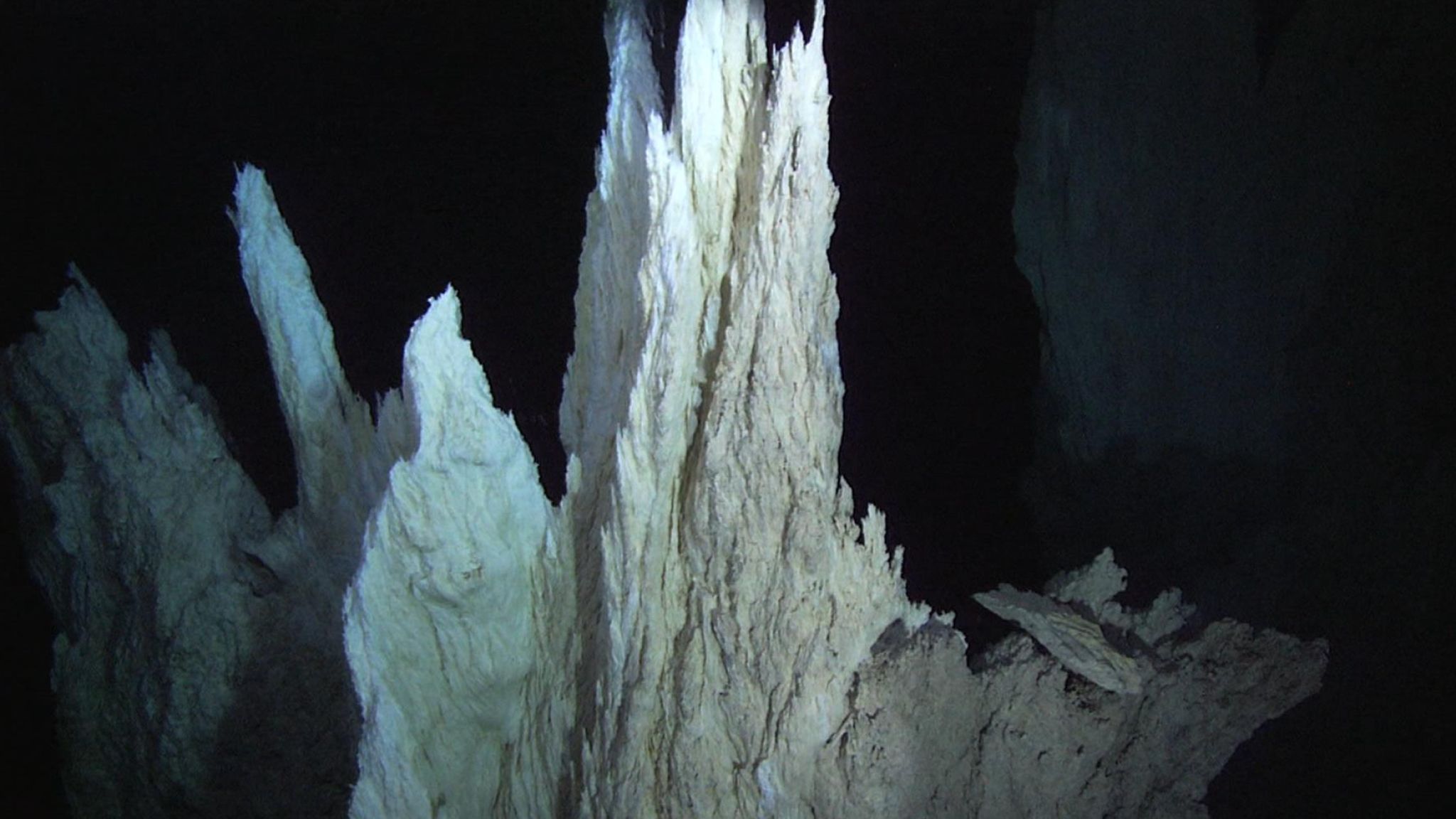

About Solwara 1

The Solwara 1 Project is a deep-sea mining project located in the Bismarck Sea of

PNG. Construction of a commercial-scale mining operation to extract deep-sea metallic mineral resources is well advanced. Production has not yet occurred.

The PEA is based on the existing mineral resource estimate at the Solwara 1 Project. The Company cautions that the PEA is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. A pre-feasibility study has not been undertaken. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

All dollar amounts in this release are presented in US dollars unless otherwise stated.

The results of the PEA represent forward-looking information that are subject to a number of risks, uncertainties and other factors that may cause results to differ materially from those presented herein. See “Forward-Looking Statements” below. Completion of the production system and initiation of mining operations at the Solwara 1 Project are also

dependent on the Company raising the remaining capital required, and there can be no

assurances that this can be achieved.

All scientific and technical information contained in this news release has been reviewed and approved by Ian Lipton, Principal Geologist at AMC, who is a “qualified person” under NI 43-101.

*Notes:

The PEA is based on a first production date of Q3 2019. The Company is currently forecasting a Q2 2019 first production date (subject to financing), but this is also subject to finalizing the ship build contract delivery date between Mawei Shipyard and MAC, and finalizing the integration philosophy and methodology (due early Q2 2018). The PEA’s effective date is 1st January 2018. Metal prices used in the PEA’s base case were $7,319/t

Cu, $1,200/Oz Au, $18.00/Oz Ag. The upside case used copper and gold prices averaged over the forward curve for the proposed production period (out to Q2 2022), on the effective date (1st January 2018), and were estimated by AMC using US$7,981/tonne Cu, and US$1,391/Oz Au prices. All other cost and production parameters are detailed in the PEA.

C1 cash costs per pound is a financial performance measure based on cost of sales and includes treatment and refinement charges and by -product credits, but excludes the impact of depreciation and royalties. C1 does not have any standardized meaning under Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards, and may not be comparable to similar measures of performance presented by

other companies.

For more information please refer to www.nautilusminerals.com or contact:

Investor Relations

Nautilus Minerals Inc. (Toronto)

Email: investor@nautilusminerals.com

Tel: +1 416 551 1100