2019 was a landmark year for deep-sea mining. As the 25th anniversary of the International Seabed Authority, the pressure was on to advance the industry from promise to production. The surge in cobalt prices in 2018 led to renewed interest in new sources of this essential but often troubled resource but also yielded a precipitous decline in value throughout 2019. Countries launched new deep ocean initiatives, while contractors put their mining tools to the test at sea. Nautilus Minerals, once the standard-bearer for the industry, faced its most challenging year to date. And the ISA continued to push forward with a draft exploitation regulations, setting an ambitious deadline of 2020 for the final mining code.

The Cobalt Crash.

After a historic rise to a record shattering value of nearly $100,000 USD per metric ton in early 2018, the price of cobalt plummeted over the last year, leveling out at approximately $32,000 USD. $32,000 USD is more in line with longer historical trends and still healthily above the high water mark for cobalt prices any time between 2012 and the end of 2017. The “Cobalt Crash” was due in large part to a surplus of cobalt in the marketplace as well as a rise in production from artisanal miners in the Democratic Republic of the Congo.

Artisanal mining is the swing producer in the cobalt mining industry, with production rising and falling in line with demand. It is also generally less well-regulated, with lower safety and labor standards than industrial production. The DC-based Conservation X Labs is currently hosting a Grand Challenge to develop sustainable solutions in the artisanal mining sector.

As with new battery technologies, while the short-term volatility in the price shouldn’t impact long-term projections for rising cobalt demand, it can certainly impact investor confidence as the deep-sea mining industry continues to develop.

Draft regulations march forward.

While process stories might not be the most exciting news, the draft regulations for exploitation in the Area continue their stately march towards approval. At two separate ISA meetings, delegates, LTC representatives, and stakeholders negotiated the nuances that will define how commercial enterprises will be realized in the deep ocean. Though many expressed frustration with the slow pace of progress, significant advances were made regarding the operationalization of the enterprise, establishment of regional environmental management regimes, and formalization the financial model. While many are still skeptical that the ISA will meet its self-imposed 2020 deadline for approval of the exploitation regulations, representatives will begin the 26th Session of the International Seabed Authority with a clear path forward for deep-sea mining.

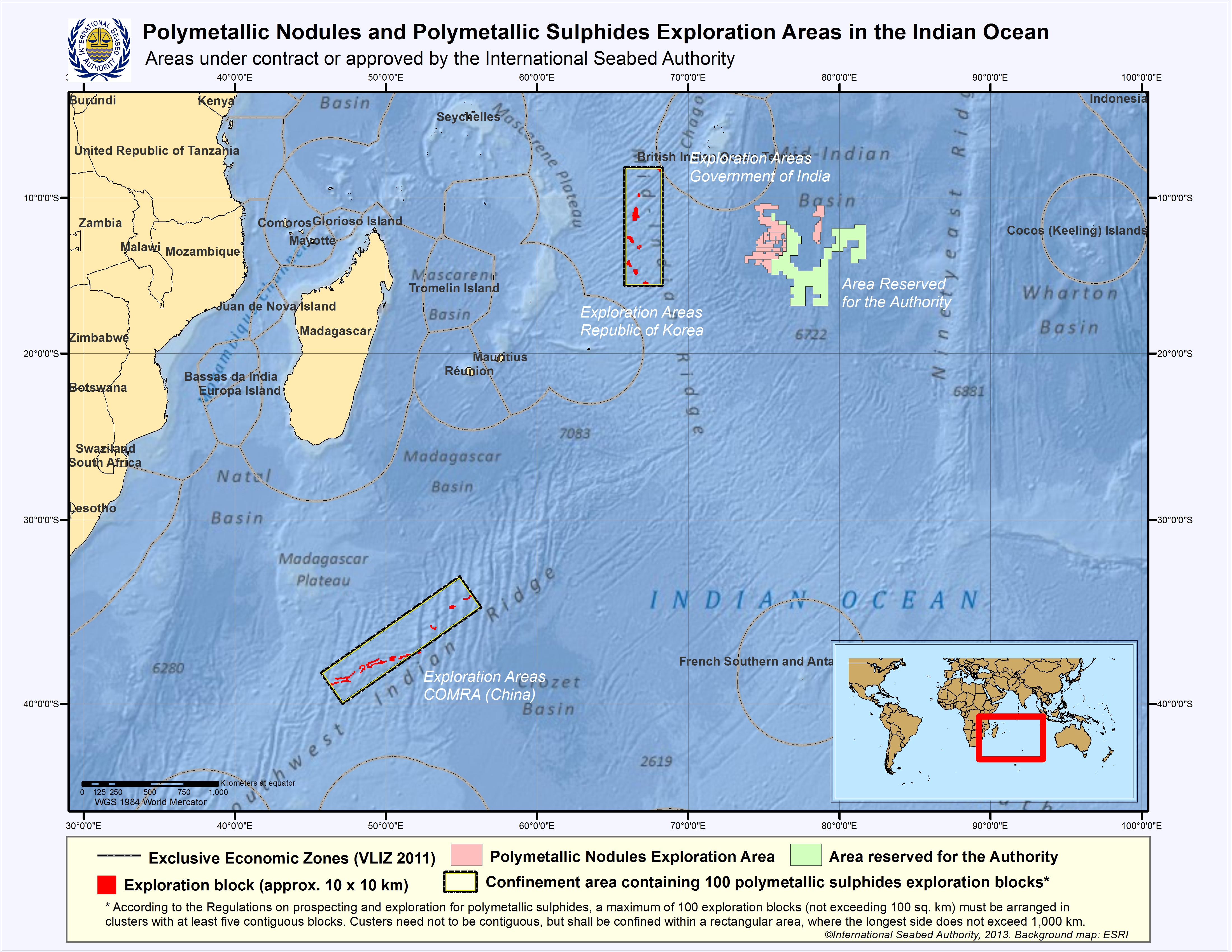

India launches an ocean initiative.

India’s Deep Ocean Mission is an initiative to dramatically expand the country’s capacity to conduct research, exploration, and exploitation in the deep waters within India’s EEZ and beyond. This new program includes a commitment to build new deep-sea capable ROVs and submersibles, including the Samudrayaan, a 6000-meter capable human-occupied vehicle that couples the standard thruster of a submersible with tracks that allow it to crawl across the seafloor. Though no public schematics have been unveiled for the Samudrayaan, the initial concept documents reveal a world-class machine ready to join the exclusive ranks of premier deep-diving submersibles.

New mining tools face trials at sea.

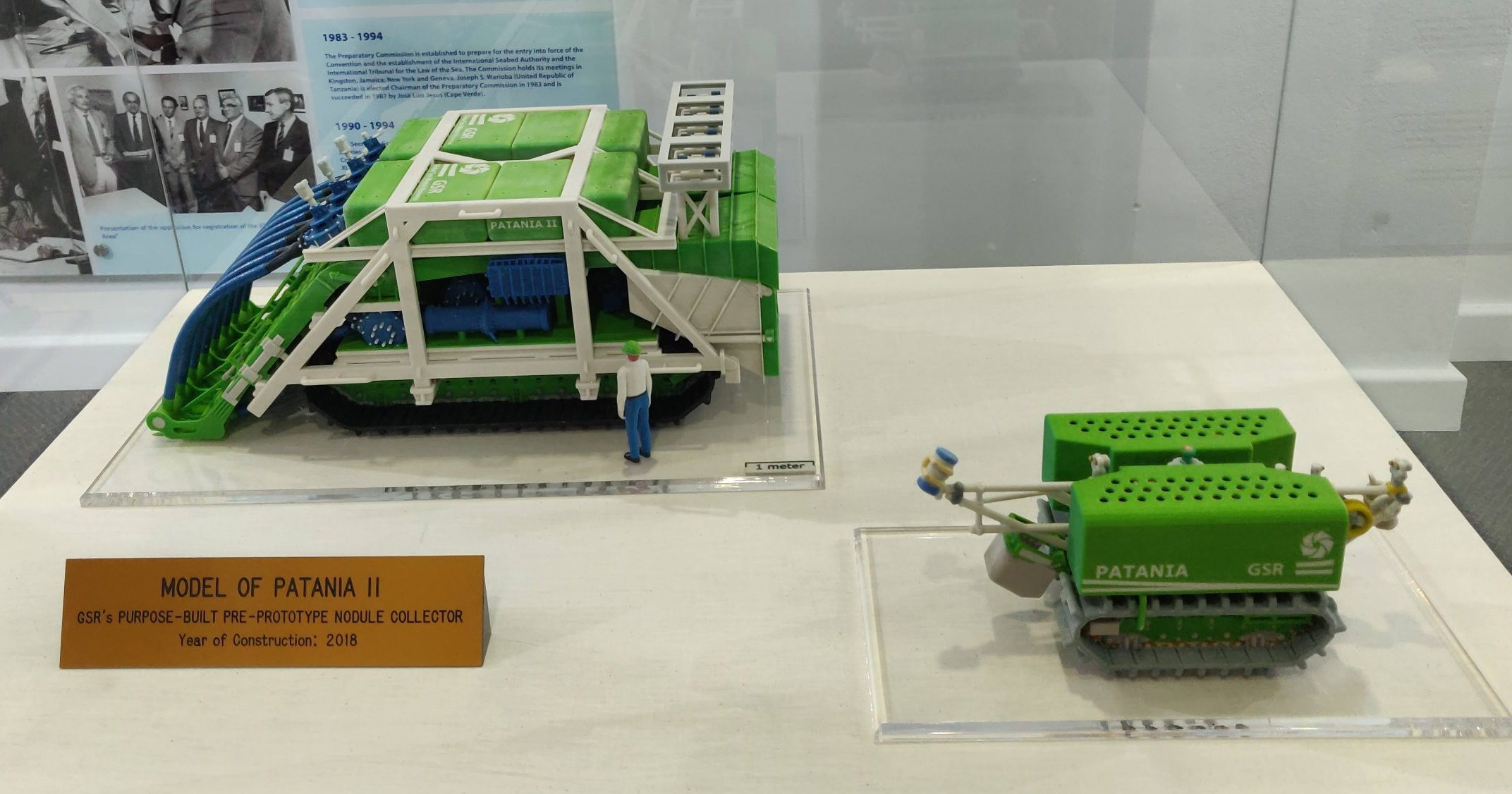

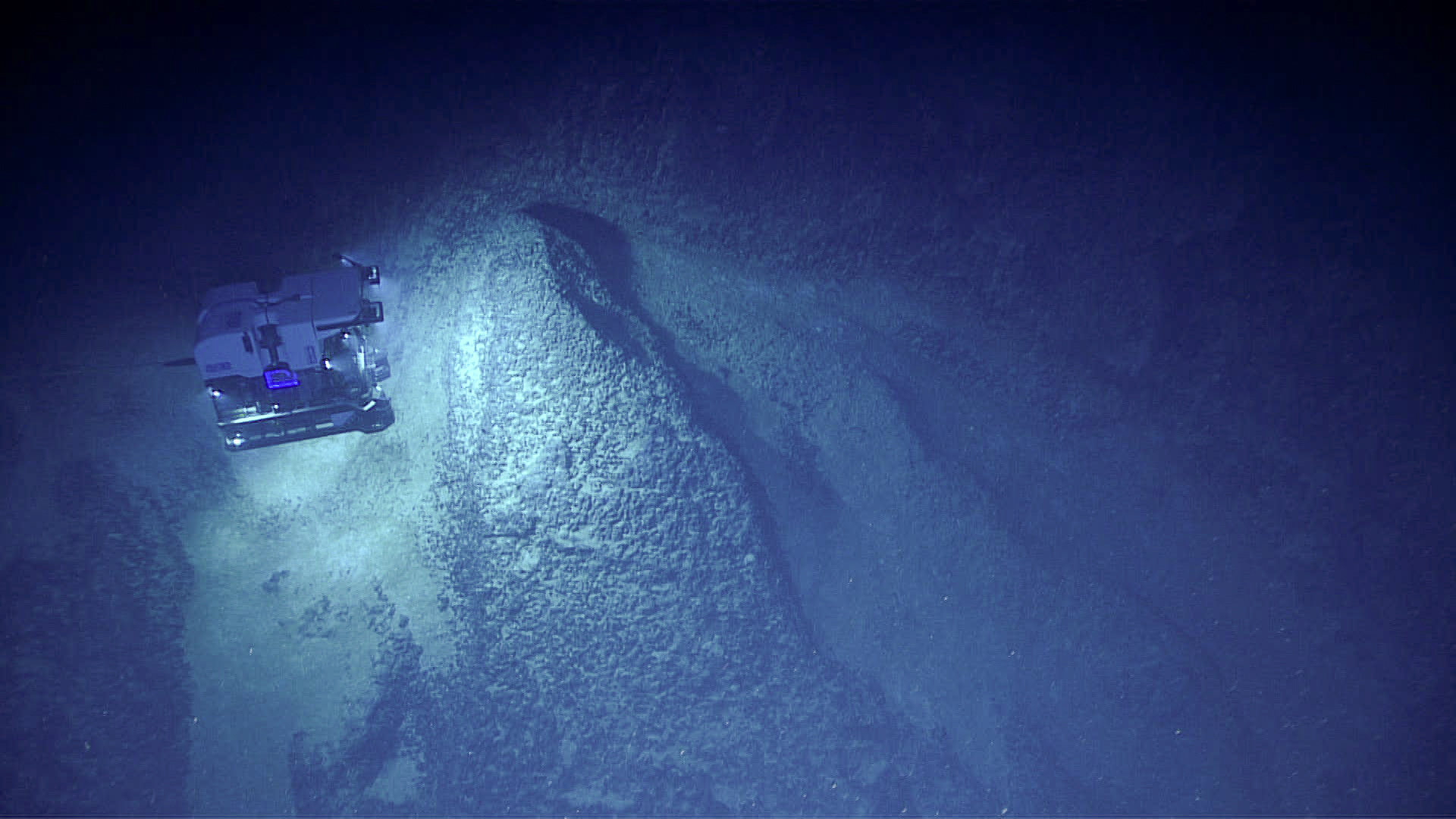

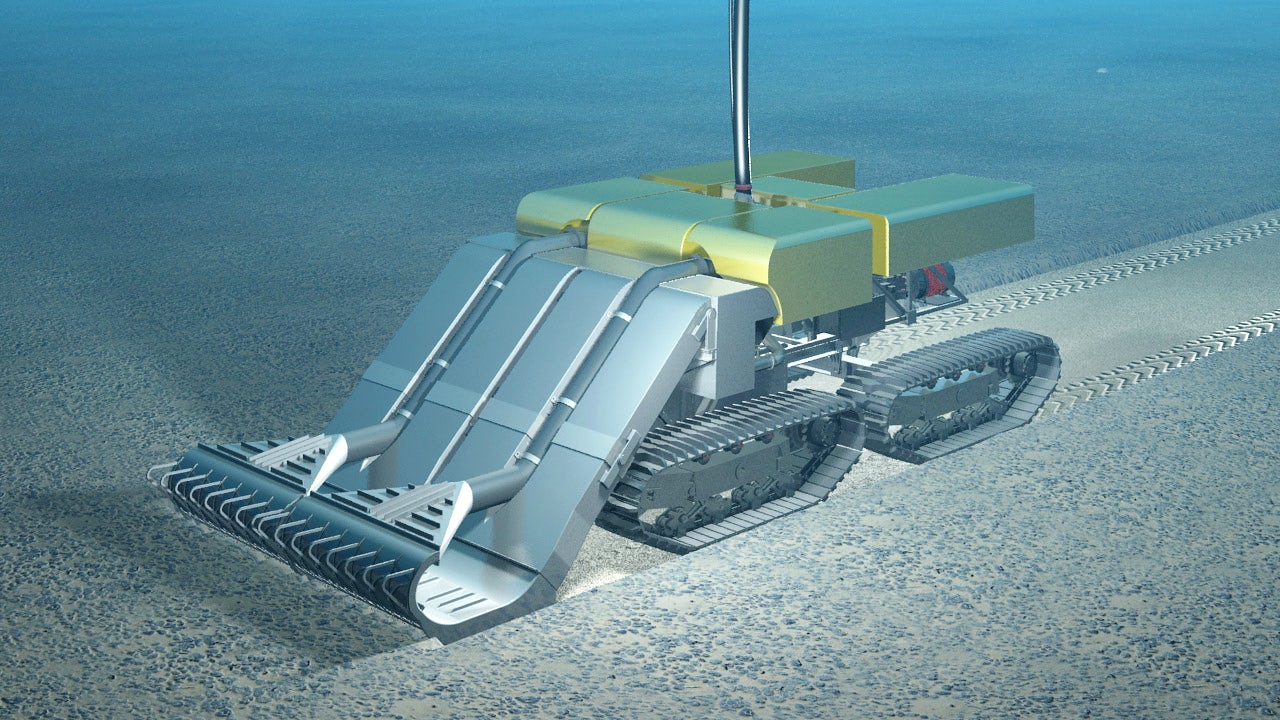

From the CCZ to the Mediterranean Sea, new tools to extract polymetallic nodules from the abyssal plain embarked upon their sea trials and faced the challenges of operating in the deep ocean. GSR’s Patania II was deployed in their Clarion-Clipperton Zone lease block. The Patania II platform is a partial system designed to test the crawler treads and nodule collectors that will be used in the final machine. It encountered significant trouble with the tether system, forcing the tests to be aborted before the machine reached the bottom. A little closer to shore in the Gulf of Malaga, Royal IHC deployed it’s Apollo II nodule collector to study the sedimentation plume produced as the machine moves across the sea floor.

Nautilus down but probably not out.

Notably not undergoing deep-sea trials is Nautilus Minerals’ seafloor production tools, which remain dry-docked in Port Moresby as the company restructures following bankruptcy. The hapless mining company, which at one point appeared guaranteed to be the first to production, has faced the most challenging year of its over-20-year history. After losing its contract to build a support vessel as well as several major investors, the company finally declared bankruptcy this year. During that process, they were sued by the Government of Papua New Guinea, in order to recoup significant outstanding debts. Though the suit was dismissed, it likely does not bode well for any future development on Solwara I.

Nautilus is never one to be underestimated, though. While their holdings in Papua New Guinea may be locked down for the immediate future, they still have development projects throughout the Pacific and in the Area. What Nautilus will become following restructuring after bankruptcy remains to be seen.

A look at what’s ahead

2020 promises to be just as consequential to the future of deep-sea mining. The DSM Observer is particularly focused on the progress of Brazil’s claim over the Rio Grande Rise, the development of new battery technologies and how that will impact mineral demand, negotiations surrounding the draft mining code, the current push among NGOs for IUCN Red Listing of deep-sea species, the deployment of new tools to explore and exploit the ocean, and how and in what form Nautilus Minerals will re-materialize.

Featured photo: Model of the Patania mining system on display at the ISA.