Interest in deep sea mining has been accelerating due to the rising price of cobalt. The metal is an important component of EV batteries, laptops and cell phones.

In October 2017, cobalt prices reached a nine-year high, trading at around US$30 per pound, tripling its 2015 value of US$10. The rise is not only seen in commodities, but in the stock market as well. A small Canadian firm Cobalt 27 Capital has seen shares increase seven-fold this year, while shares in the Chinese firm Zhejiang Huayong Cobalt have roughly tripled.

This jump has made cobalt the top performing base metal this year, a performance being fueled in dual part by the rise of electric vehicles and a shortage in ethically-sourced cobalt.

Andreis Gerbens, a cobalt specialist at Darton Commodities, told CNN that about 10% of current cobalt production goes towards electric car batteries, but that demand is expected to surge as electric vehicle production increases and as countries, from China to Norway, seek to ban production of fossil fuel powered vehicles. OPEC estimates some 140 million fully electric cars to be on the roads by 2040, a forecast some see as conservative.

But Gerbens notes that there are “questions about whether there will be enough critical raw materials” to meet the auto industry’s needs.

60% of the world’s current supply of cobalt comes from the Democratic Republic of Congo. However, the nation has a reputation for instability and human rights violations, including purported child labor at the African artisanal mines from which a portion of cobalt is sourced. This has investors nervous and primary users, such as cell phone maker Apple Inc., walking away from unethically-sourced DRC cobalt.

Another factor is that cobalt is a byproduct of copper and nickel production, and is not mined on its own. And there’s little demand for new traditional land-based copper and nickel mines.

This dilemma has some Asian battery makers tweaking the recipe for lithium-ion batteries by reducing the amount of cobalt and adding more nickel. Yet this is a stop-gap measure at best as forecasts predict a continued surge in demand.

But not everyone agrees that the current situation is critical. Anton Berlin, head of strategic marketing for Russia’s Norilsk Nickel, told Reuters this month that, “The price is higher but there is no tense situation with cobalt supply now.”

“Everyone is looking into the future, looking at the charts of future demand for electric cars and when they start to transform them into cobalt, they see gold mines. But it is a vision of the future,” states Berlin.

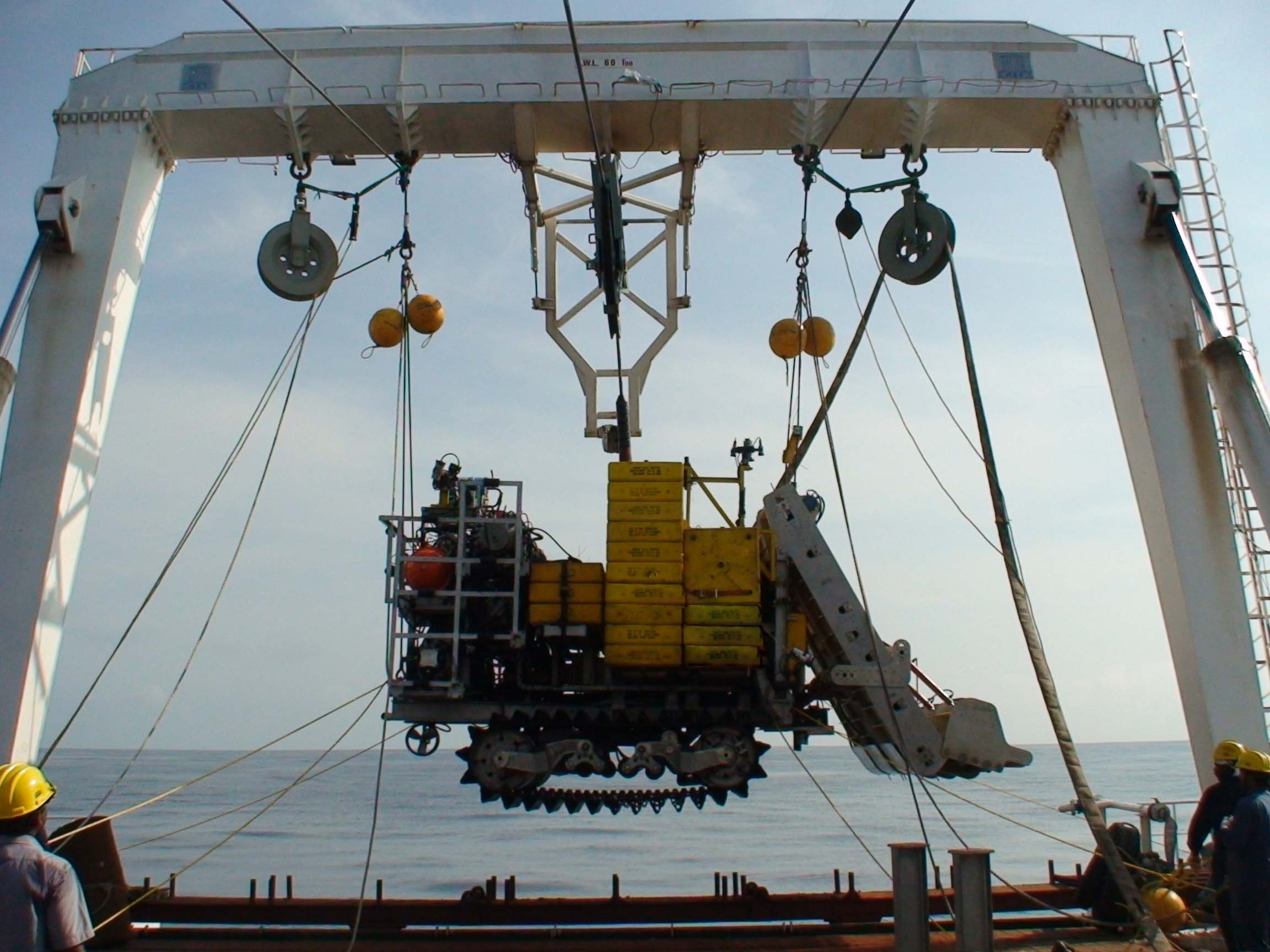

And that future may lie beneath the sea.

Polymetallic nodules are a potential major source for the metal. In fact, 15-20% of the world’s presently known supply of cobalt may sit on the seabed within the Cook Islands Exclusive Economic Zone alone. This provides a powerful incentive for island states like the Cook Islands to explore and develop this resource. It is also a driver among the international community to finalize a legal framework under the International Seabed Authority (ISA), an agreed upon “Mining Code” that would permit contractors to begin extracting these nodules from international waters.